These accounts come in two types: the Traditional IRA and Roth IRA.

These plans are useful if your employer doesn’t offer a 401(k) or other qualified employer sponsored retirement plan (QRP), including 403(b) and governmental 457(b), or you want to save more than your employer-sponsored plan allows.

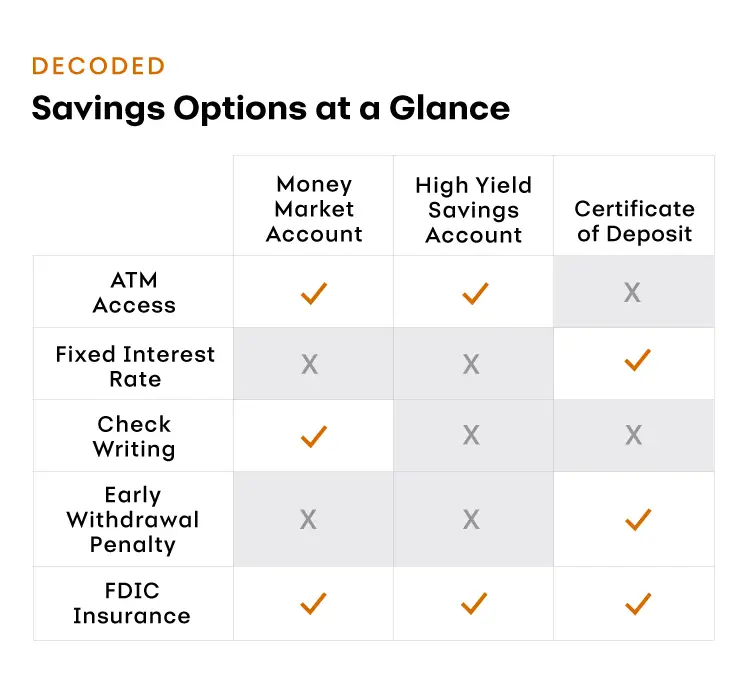

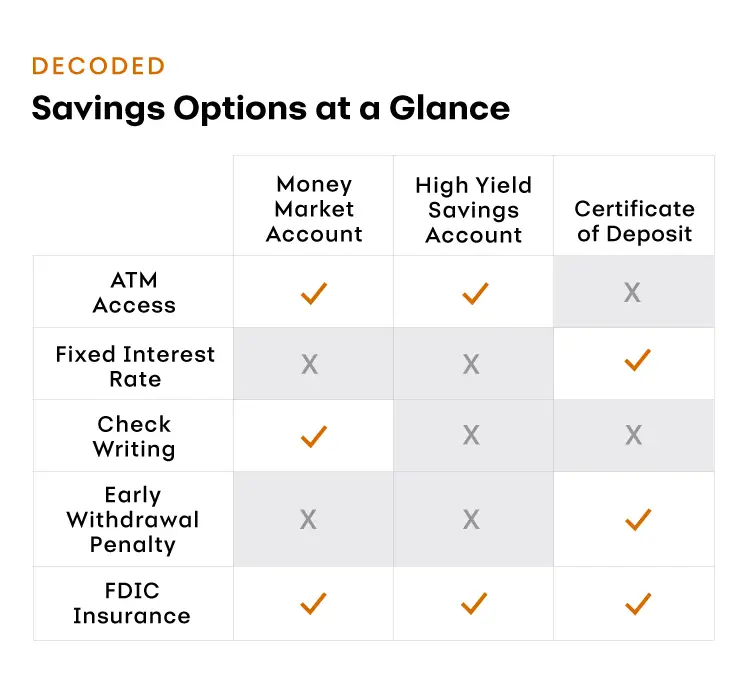

Individual Retirement Accounts (IRAs): IRAs, or Individual Retirement Accounts, allow you to save independently for your retirement. Some money market accounts also allow you to write checks against your funds, but may be on a more limited basis. Money market accounts can have tiered interest rates, providing more favorable rates based on higher balances. Both savings and money market accounts have variable rates. Money market account: Money market accounts are similar to savings accounts, but they typically require you to maintain a higher balance to avoid a monthly service fee. Be sure you will not need the funds before the end of the CD term, as early withdrawals may have financial penalties. CDs often have higher interest rates than traditional savings accounts because the money you deposit is tied up for the terms of the CD. Certificate of Deposit (CD): Certificates of deposit or CD, allow you to save your money at a set interest rate for a pre-set period of time - which can range from a few months to several years. Understanding the account’s terms and benefits will allow for a more informed decision on the account best suited for your needs. Savings accounts vary by monthly service fees, interest rates, and account features. Interest rates can be compounded on a daily, weekly, monthly, or annual basis. Savings account: A savings account allows you to accumulate interest on funds you've saved for future needs. To determine the most economical choice, compare the benefits of different checking accounts with the services you actually need.

Accounts may have different options to help avoid the monthly service fee.

Customers can typically use a debit card or checks to make purchases or pay bills.

Checking account: A checking account offers easy access to your money for your daily transactional needs and helps keep your cash secure. Here are some definitions to help you navigate your banking needs: To make these decisions, it’s helpful to first understand the differences between the most common bank account types. Should you choose the basic checking option or an account that earns interest? Do you want the convenience of a bundled checking and savings account or the higher returns of a money market account? If the original maturity term of the CD is more than one year, it will renew at the current interest rate for the next highest maturity term unless the original term is disclosed on the rate sheet.When you go to a bank to open a new account, you will have a variety of account types and features to choose from. If the original maturity term of the CD is one year or less, it will renew at the current interest rate for the one-year CD. For CDs with terms of 14 days or less, you can withdraw your funds on the maturity date without being assessed a penalty.ĬD Specials – If the Time Account is a “CD Special,” it will renew for the exact term originally purchased. For CDs with terms of 15 days or more, you will have ten (10) calendar days from the maturity date to withdraw your funds without being assessed a penalty, or to notify the bank if you wish to change the rate and/or term of your certificate. #Money market account plus#

Withdrawal of Interest Prior to Maturity – The “Annual Percentage Yield” assumes interest remains on deposit until maturity and that a withdrawal will reduce earnings.Ĭompounding and Crediting Frequency – Interest will be compounded daily and paid at least annually (unless otherwise designated on the CD Account Agreement).Īccrual of Interest on Noncash Deposits – Interest begins to accrue no later than the business day we receive credit for deposit of non-cash items (for example, checks).ĭaily Balance Method Computation – We use the daily balance method to calculate your interest, applying a daily periodic rate to the collected balance plus earned interest.Īutomatically Renewable Time Account – This account automatically renews at maturity at the then current interest rate for the term selected.

0 kommentar(er)

0 kommentar(er)